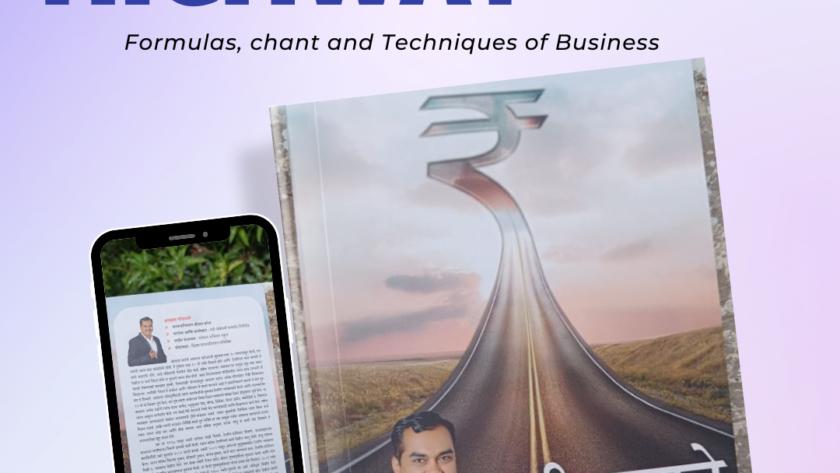

सक्सेस मंत्र

परिचय "मनी हायवे" हे पुस्तक आपल्यासाठी लिहिलेले आहे, ज्यामध्ये बिझनेसचे सूत्रे, मंत्र आणि तंत्र खूप सोप्या पद्धतीने मांडलेले आहेत. हे पुस्तक वाचकांना बिझनेसच्या जगात मार्गदर्शन करते, त्यांना प्रभावीपणे त्यांच्या उद्दिष्टांपर्यंत पोहोचवते, आणि त्यांना यशस्वी होण्यासाठी आवश्यक असलेल्या कौशल्यांची माहिती देते. पुस्तकाचा सारांश सूत्रे: बिझनेसचे मूलभूत तत्वे आणि सिद्धांतांची ओळख करून देण्यात आलेली…